Financial goals can feel intimidating when they loom in the distant future. By breaking large goals into manageable tasks and anchoring them to dates you already care about, you transform vague ambitions into concrete action plans. Linking savings targets to calendar events helps you stay organized, maintain discipline, and celebrate every milestone along the way.

In this guide, we’ll explore the psychological advantages of timing your savings, outline practical steps to build a dynamic savings calendar, and provide tools and tips to keep you motivated and on track.

Humans respond powerfully to deadlines. When you schedule a date in your calendar, you create natural deadlines and discipline that heighten focus. Studies show that writing down your goals increases the chance of success by 42%. By coupling a savings target with an event that holds personal meaning—like a birthday or vacation—you tap into an emotional impetus that drives you forward.

Every reminder on your calendar becomes a checkpoint. You’ll feel compelled to review progress and adjust if needed, turning an abstract plan into a living, breathing roadmap. The anticipation of an upcoming event keeps savings in the front of your mind, rather than buried in browser tabs or forgotten bank apps.

The first step is choosing a calendar format that works for your style, whether a digital app, a wall calendar at home, or a detailed spreadsheet. Then follow these essential steps:

By mapping each financial target to an event, you avoid last-minute scrambles and forgotten payments. Instead, you’ll have a clear timeline that dovetails with your routine.

An effective savings plan adheres to the SMART framework: Specific, Measurable, Achievable, Realistic, and Time-bound. For instance, rather than “save for vacation,” opt for “save $2,000 by June for summer trip”. This phrasing tells you exactly how much to save, by when, and for what purpose.

Use online calculators to determine precise monthly targets. A $2,000 goal over 12 months translates to $166.67 per month. If your bank offers even a modest interest rate, you’ll need slightly less from each paycheck, letting compound growth work in your favor.

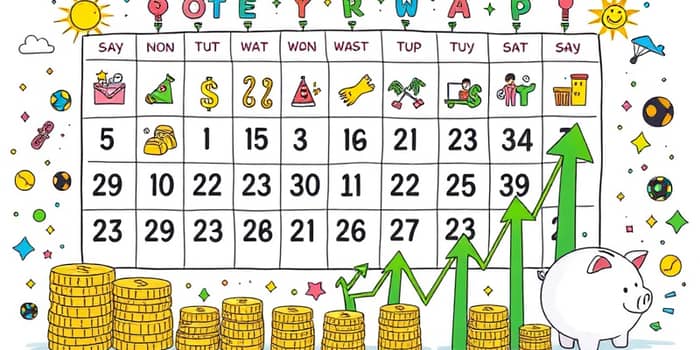

Transform theory into action with this easy template:

Leverage modern apps and online services to make your plan almost effortless:

No plan is immune to surprises. If your contributions fall behind, resist the urge to give up. Instead, consider:

- Extending the timeline by a month or quarter

- Slightly lowering the savings target if it’s straining your budget

- Reprioritizing which events deserve top funding

Regularly tracking your status and adjusting prevents discouragement and keeps you moving forward even in tough months.

Certain times of year naturally invite financial planning. During Financial Literacy Month in April, review all calendar-linked goals. In October’s open enrollment period, budget for health premiums and out-of-pocket expenses. These recurring touchpoints serve as excellent checkpoints for your emergency fund and long-term plans.

Staying motivated over months can be challenging. Start with small wins—perhaps saving just $25 this month—and gradually ramp up. Visualize progress with charts or a sticker system on your wall calendar. Treat yourself to a modest reward when you hit a milestone. These tiny celebrations reinforce positive habits and sustain enthusiasm.

By tying savings to dates you already care about, you inject purpose into each deposit. Over time, this approach doesn’t just build your account balance—it cultivates lasting financial confidence and discipline.

Linking your savings goals to specific calendar events transforms abstract dreams into structured plans. With clear deadlines, SMART targets, and the right tools, achieving big financial milestones becomes not just possible but inevitable. Start today by picking your next event, scheduling your first deposit, and watching how small, consistent steps lead to life-changing results.

References